Trump’s new tax plan screws the middle class

By Bryce Covert, September 18, 2016

For months, Republican presidential nominee Donald Trump had distanced himself from his own tax plan, released during the primary campaign, and promised to put out a new version. He finally followed through on that promise last week, releasing details as part of what he called an “economic policy package.”

But while Trump had originally disavowed his own proposal because he wanted to give the middle class a bigger benefit, his new plan ends up doing the opposite.

In May, he was asked about analyses that found most of the tax cuts went to the richest 1 percent of Americans. “I will say this, and I’m not necessarily a huge fan of that,” he responded. “I’m so much more into the middle class who have just been absolutely forgotten in our country.”

Later he said of the new plan that the wealthy would end up paying more, while under his new plan, “Everybody’s getting a tax cut, especially the middle class.”

But the new plan is out, as is a new analysis from the Tax Foundation. And it does not find this to be the case.

There is some confusion about how Trump’s plan would treat income individuals make from pass-through businesses, which pay tax through the individual tax code by immediately showing up on the owners’ own tax bills and not through the corporate rate. Think an LLC, not Google or McDonald’s. The campaign hasn’t adequately specified whether this income will be subject to the top rate on income — 33 percent— or the lower corporate tax rate of 15 percent.

Many pass-through businesses are quite small, while others are larger, like law and real estate firms. Trump’s own business, the Trump Organization, is an LLC, so allowing all income from it to be taxed at the lower 15 percent rate would give him an enormous break.

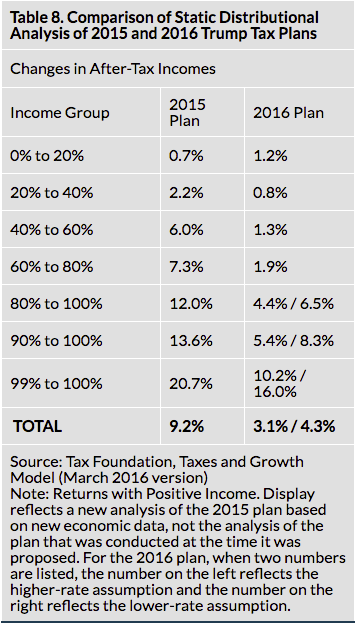

But either way, one thing is clear: the middle class will get less than Trump had originally planned, while the rich will get more. Those in the middle three-fifths of the income scale would have seen their incomes boosted by 2.2 percent, 6 percent, and 7.3 percent under his original proposal; those increases have been sharply reduced to 0.8, 1.3, and 1.9 percent.

Meanwhile, depending on how passthrough income is handled, the richest Americans also see their tax cut pared back, but not by nearly as much. Originally, the top 10 percent would have seen a 13.6 percent increase in its come and the top 1 percent would have gotten a whopping 20.7 percent. Those have been cut back to either 5.4 or 8.3 percent and 10.2 or 16 percent, respectively, depending on the details.

CREDIT: Tax Foundation

The rich, therefore, still get the majority of the benefit from Trump’s tax plan.

The Tax Foundation has more bad news for Trump. Last week as he unveiled his plans, he claimed they would create as many as 25 million jobs within ten years. But the analysis found that his tax plan would only create somewhere between 1.8 million and 2.2 million jobs over a decade, which would mean the rest of the more than 20 million jobs would have to somehow be a result of his trade, immigration, and energy plans.

The Tax Foundation also relies on a questionable method to get to these numbers, deploying the dynamic scoring model that bakes in assumptions about how tax cuts will affect future economic growth. Those assumptions are almost always impossible to make with certainty, and they also assume tax cuts lead to big growth, which is rarely the case.

Trump’s tax package also remains costly. Originally the Tax Foundation had found that his first plan would cost $10 trillion over a decade; while the new one has a much lower price tag, it’s still $4.4 trillion or $5.9 trillion on a static basis, depending on the treatment of passthrough income, or $2.6 trillion to $3.9 trillion with dynamic scoring.

...................................................................................................................................................................

No comments:

Post a Comment