Mark Cuban lays out why he believes Donald Trump 'won't and can't' release his taxes

By Allan Smith, August 31, 2016

Billionaire business mogul Mark Cuban explained in a series of tweets on Wednesday why he thinks Republican nominee Donald Trump "won't and can't release his tax returns."

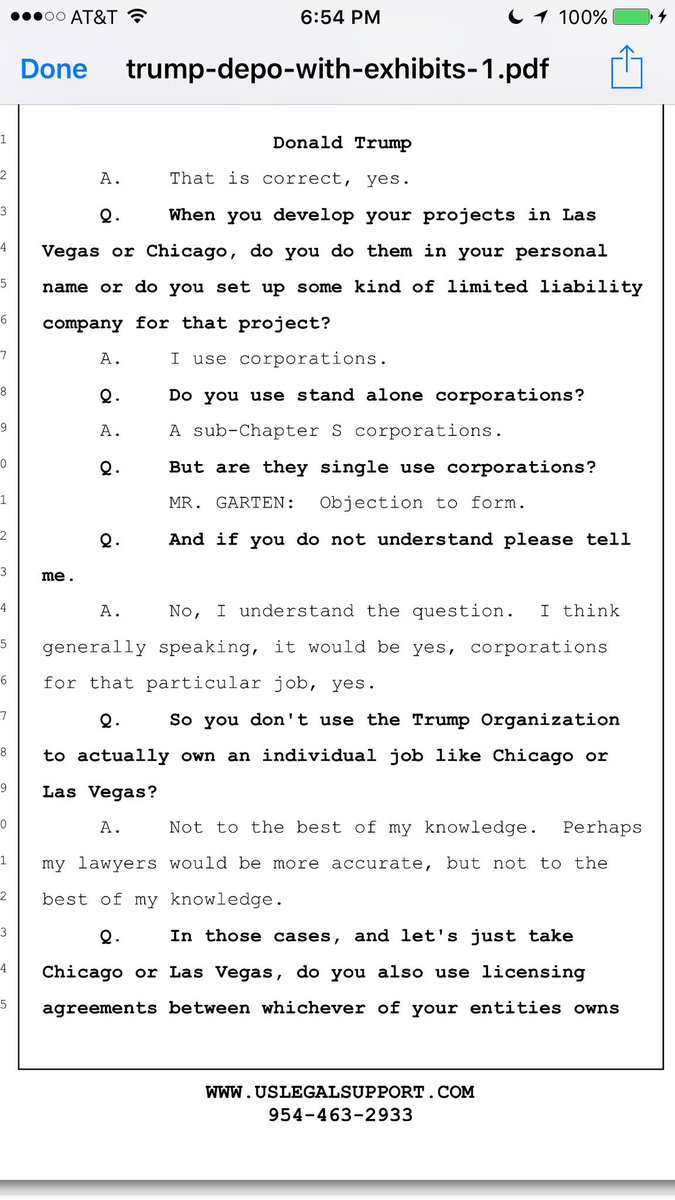

Cuban, the owner of the NBA's Dallas Mavericks and a star of ABC's "Shark Tank," used a 2013 deposition from Trump — uploaded by The Washington Post as a part of its "Trump Revealed" project — to make his point.

In that deposition, Trump said in response to a question about the development of Trump properties in Las Vegas and Chicago that he set up single-use subchapter S corporations to develop projects. He said he did not use the Trump Organization for those types of projects.

As Cuban pointed out, with an S-corporation, "the entire financial performance of his company becomes part of his tax return."

According to the Internal Revenue Service, S-corporation shareholders must "report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates." And S-corporations are responsible "for tax on certain built-in gains and passive income at the entity level."

"His personal tax returns would show the financial performance of his development projects," Cuban wrote. "Not good given how much he gets sued."

"It may also explain why reducing pass-through taxes is important to him," he continued. "I say 'may' because taxes are only paid if he makes a profit."

Democratic nominee Hillary Clinton recently hit Trump in a major economic speech for his new tax position on what is known as pass-through income, calling it the "Trump loophole" and arguing that the tax break would be extremely beneficial to Trump.

Pass-through income "passes through" the business to the individual returns of its owners. CNBC's Robert Frank cast the loophole as the biggest tax break for the wealthy in Trump's plan. Though analyses have shown that a plan similar to Trump's would aid small businesses, most of its benefits would go to wealthier business owners.

Pass-through income today is taxed at individual rates, with a ceiling of 39.6%. Trump's plan slashes the tax rate for this income to 15%.

An analysis by the Center on Budget and Policy Priorities showed that the vast majority of pass-through income goes to the top 1% of earners, with the top 400 earners in 2013 acquiring 20% of their total income this way. For those 400 people, that came out to slightly more than $94 million each on average.

Trump has repeatedly insisted he will not release his tax returns until after an audit by the IRS is completed, which he said may not be before the November election. All major-party presidential candidates since 1976 have made their tax returns public.

Cuban endorsed Clinton at a rally in Pittsburgh, his hometown, last month. In that rally, he referred to Trump as a "jagoff" — a demeaning slang term frequently used in western Pennsylvania — during the event. Cuban has ripped Trump repeatedly on social media in recent months.

Cuban expressed interest in serving as either Trump's or Clinton's running mate earlier in the cycle before souring on the real-estate magnate's candidacy. In a Monday tweet, he wrote that he knew there "was no chance" being picked as a running mate "was happening."

Read Cuban's tweets below:

Mark Cuban ✔ @mcuban

1) I'm going to explain, using a trump deposition, exactly why @realDonaldTrump won't and can't release his tax returns

6:57 AM - 31 Aug 2016

Mark Cuban ✔ @mcuban

2) Trump states in his attached deposition that he uses Sub Chapter S corporations for his development projects.

6:58 AM - 31 Aug 2016

Mark Cuban ✔ @mcuban

3) with a Sub Chapter S corp the entire financial performance of his company becomes part of his personal tax return https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations …

7:01 AM - 31 Aug 2016

Mark Cuban ✔ @mcuban

4) His personal tax returns would show the financial performance of his development projects. Not good given how much he gets sued

7:05 AM - 31 Aug 2016

Mark Cuban ✔ @mcuban

5) it may also explain why reducing pass through taxes is important to him. I say "may" because taxes are only paid if he makes a profit

7:06 AM - 31 Aug 2016

...................................................................................................................................................................

No comments:

Post a Comment